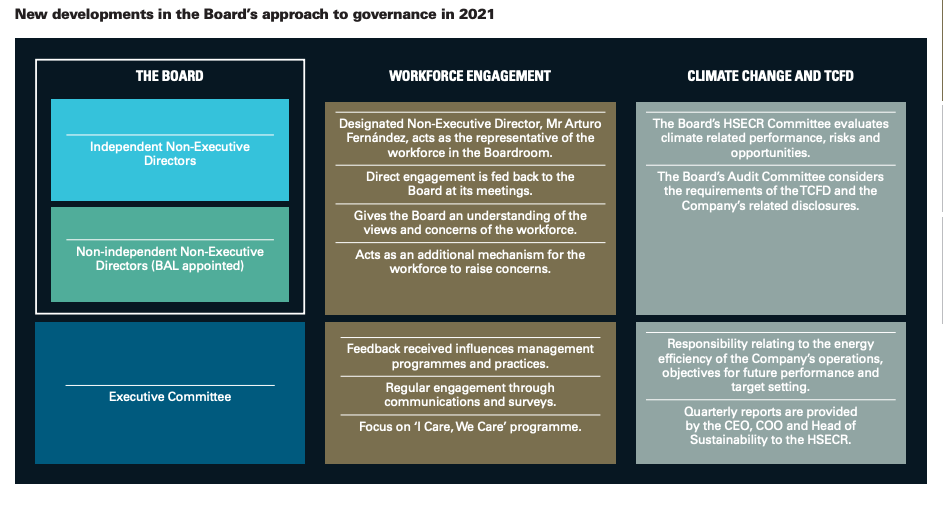

The board is paramount to corporate governance, appointed by shareholders to oversee the company’s strategy, management, and performance. Its primary duty is to select and oversee the chief executive officer, monitor management’s performance, and ensure legal and ethical conduct. In undertaking these responsibilities, the board must ensure the company’s long-term viability, consider sustainability issues, and the company’s relationships with key stakeholders, including a recent and increasing focus on climate-related risks and opportunities. For disclosure of the governance of climate-related risks and opportunities, see Climate Governance.

Qualifications and Independence - describe the criteria for selecting board members, including independence, diversity, and sustainability competence. Climate change is now a pressing and important issue for most companies, so board members should be skilled in understanding its consequences. Recruit directors with this skill or train board members, or consider consulting external advisors in either case.

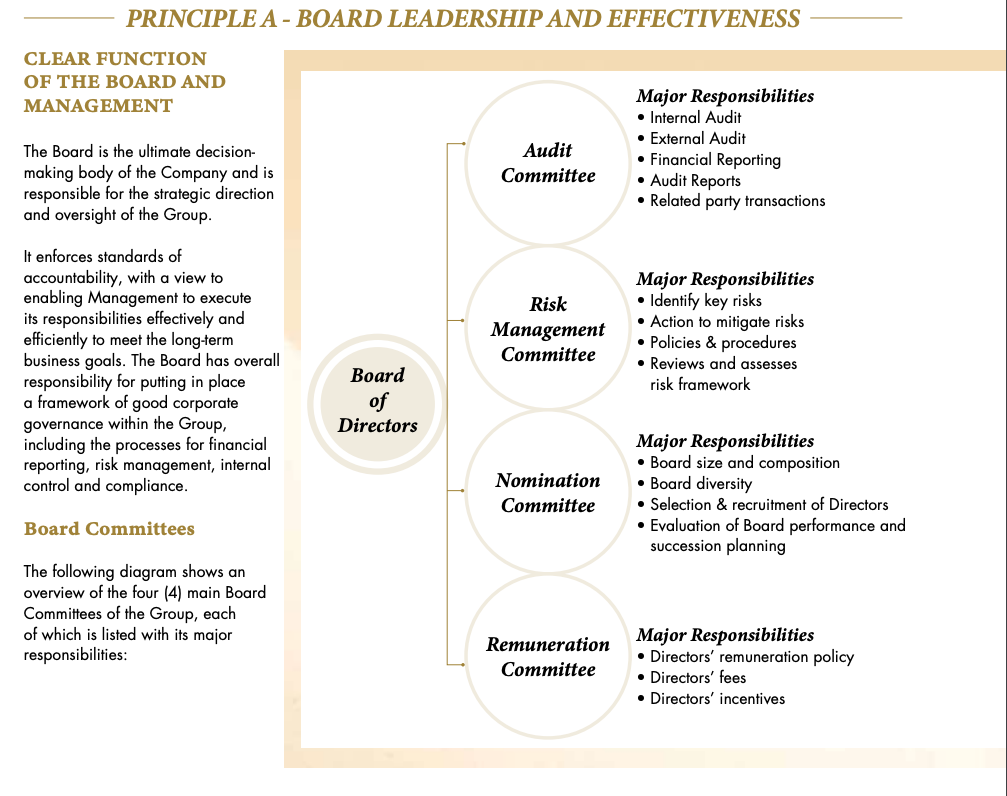

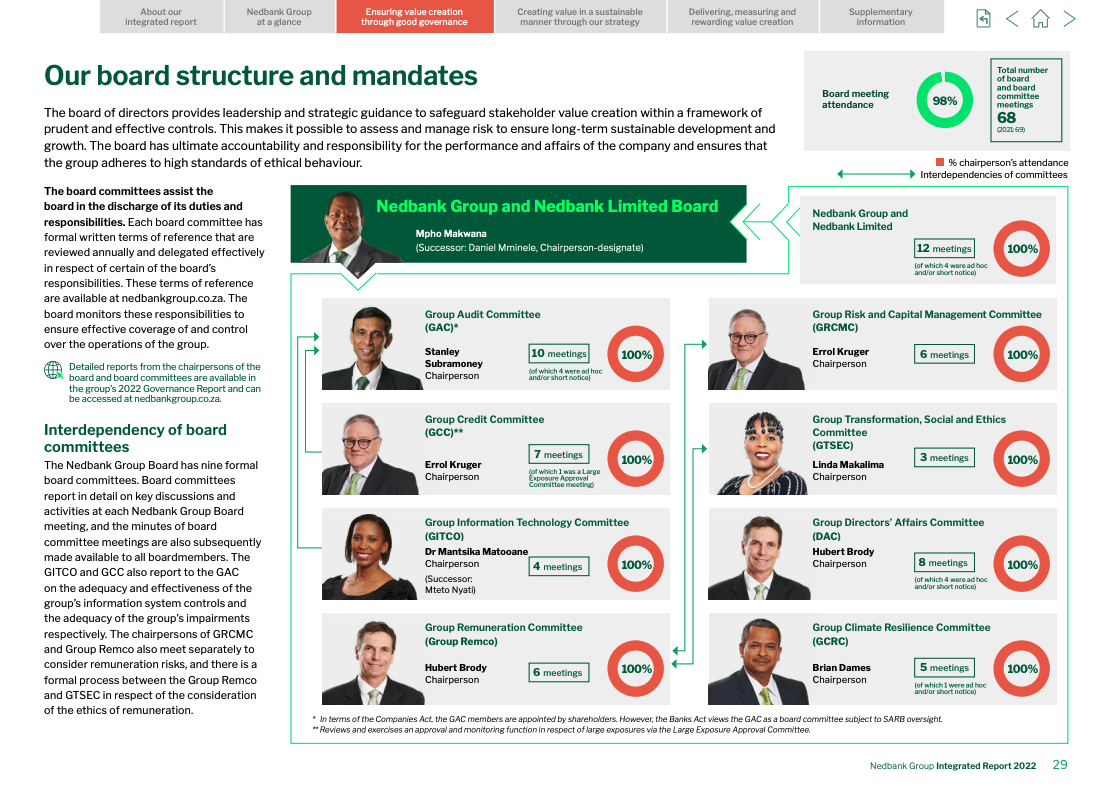

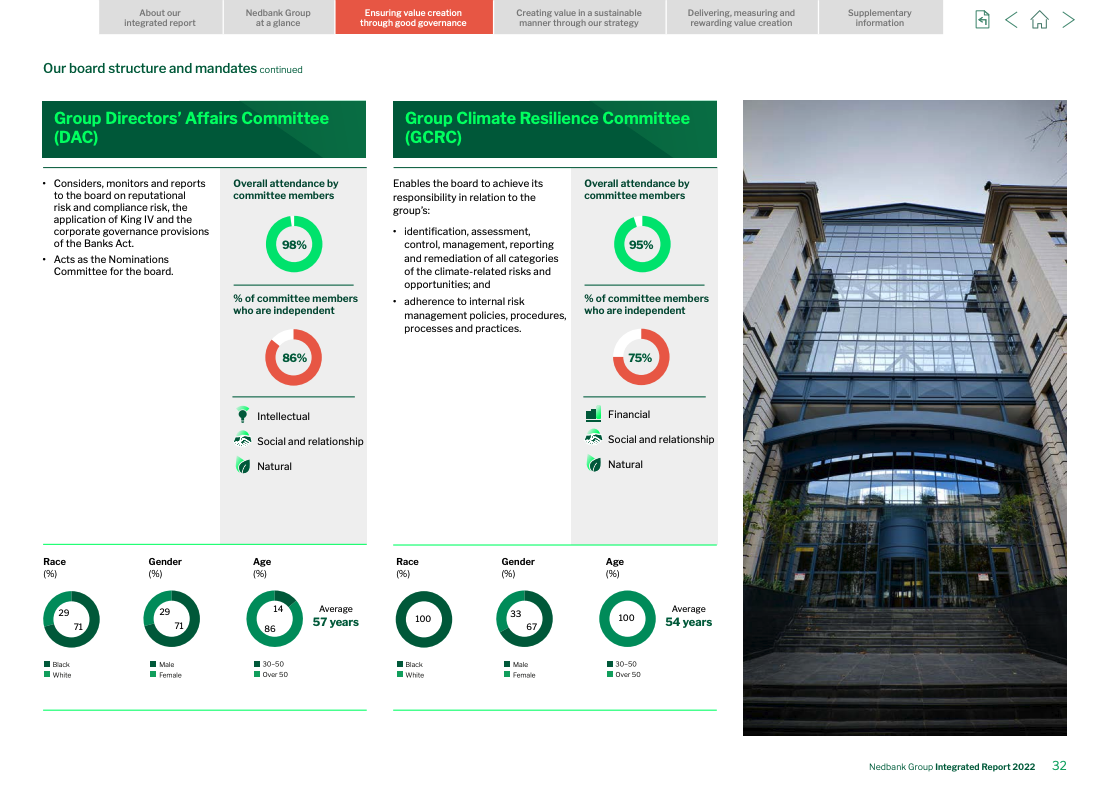

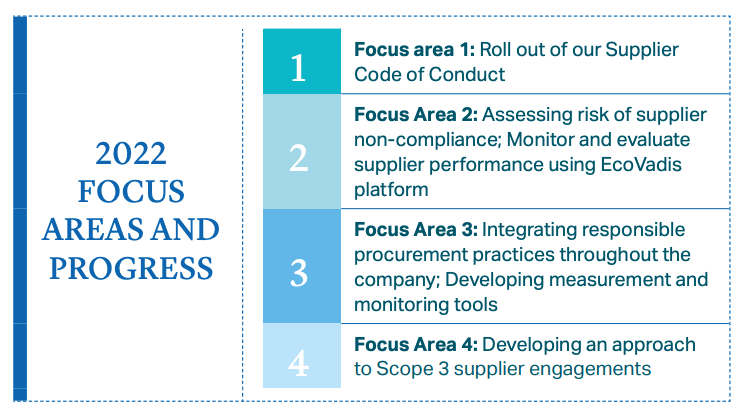

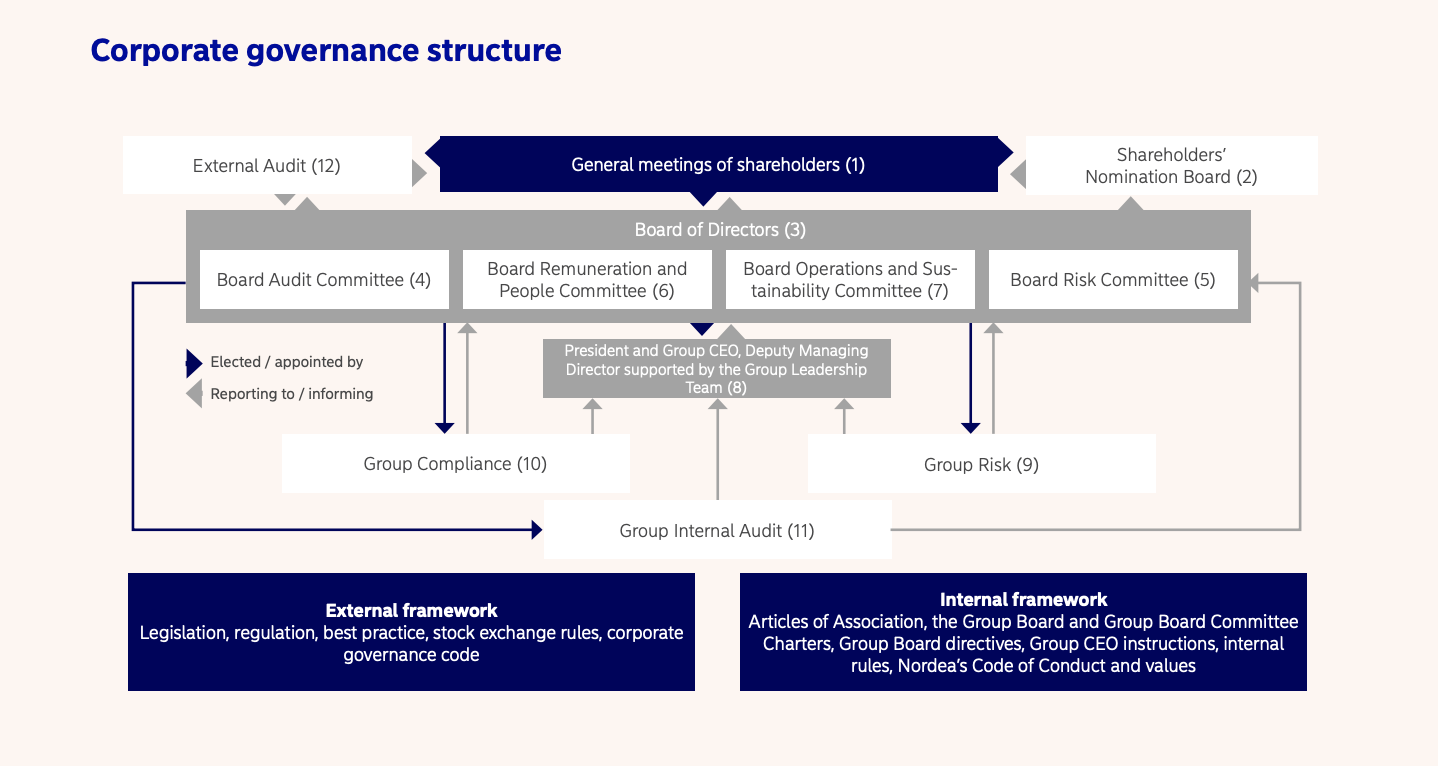

Board Work and Committees - describe the board’s duties and responsibilities and its role in strategy, risk, and performance. Each area should include sustainability-related risks and opportunities, the board relationship with senior management, and board committee structure and responsibilities. Address the frequency of board and committee meetings.

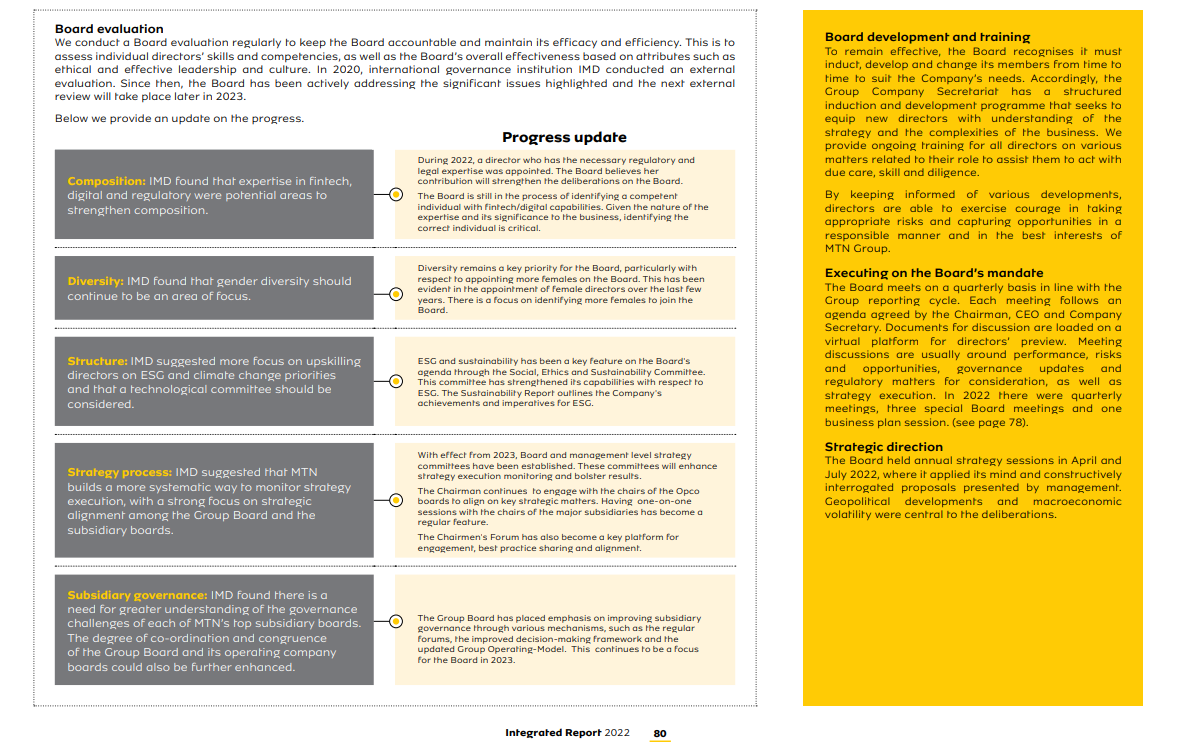

Board Evaluation - describe the process of annual evaluations of the board, the board members individually, and the board committees.

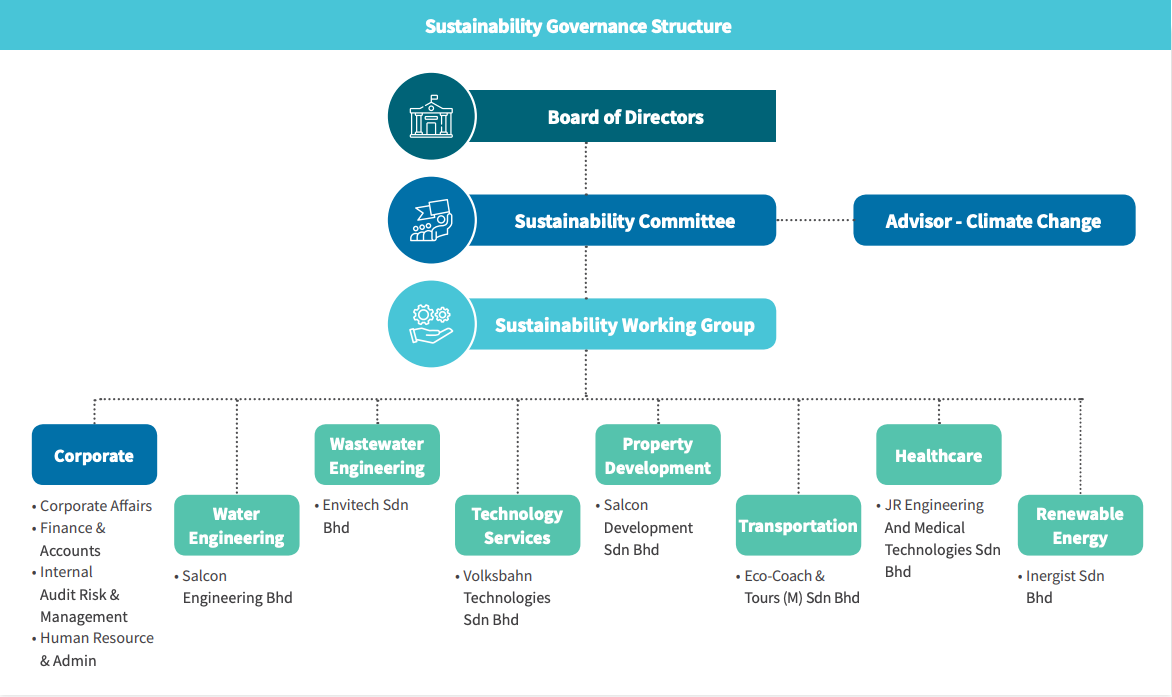

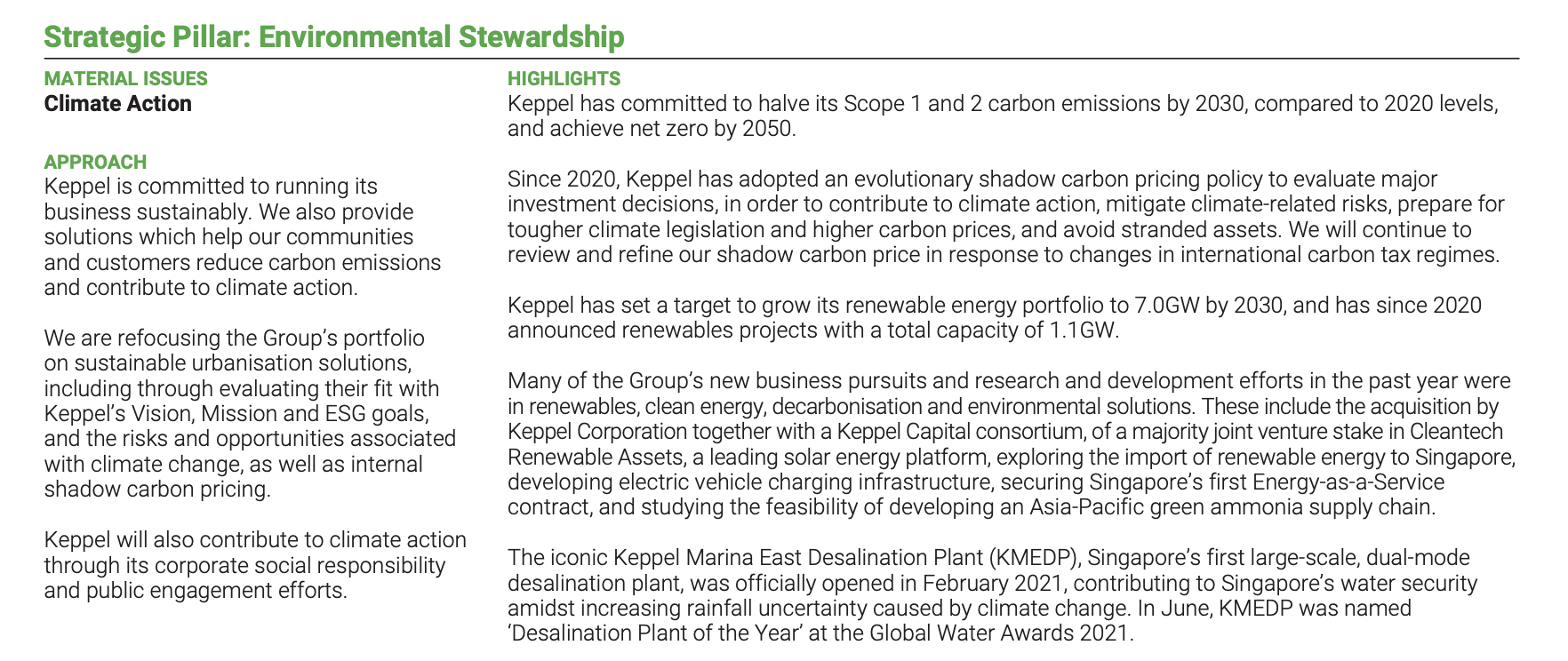

Governance of Sustainability - describe the process for inclusion and oversight of sustainability and climate risks and opportunities at the board and the senior management levels.

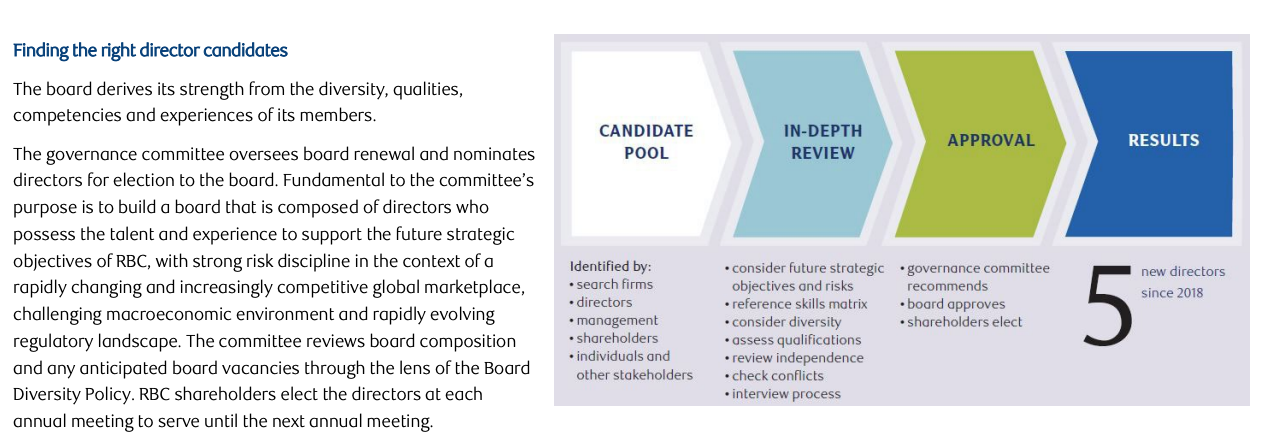

Nomination and Appointment

Describe the process of nominating and appointing directors and summarize the roles of the board, the nomination committee (if any), and shareholders in nominating and appointing board members. Specify the independence (or other) of each board member, the term of each director, and whether they have been reappointed for multiple terms. If companies have board members representing employees, creditors, or government, describe how each is appointed.

Qualifications and Skills

Describe each board member’s relevant age, gender, background, work experience, and education and any other board positions and current employment held by the board member. Emphasize board members’ qualifications, skills, and competencies that are relevant to their board roles, including serving on any committees, and link to the company’s wider strategy and purpose. The global focus on sustainability and climate-related action suggests that boards include sustainability or climate-related skills (or both) among their members.

Sustainability

Describe the board’s expertise on broader sustainability matters and whether board members receive training on environmental, social, and governance (ESG) issues generally and for the industry sector in particular or have access to sustainability expertise externally. Describe the board committee responsible for applying and overseeing the sustainability governance framework, policies, plans, and reporting and relations with management.

Good Practice

The concept of the strategic asset board suggests that companies have a longer-term board succession plan in place to ensure that the board’s composition and qualifications are aligned with the company’s strategy and the qualifications of directors required for the future.

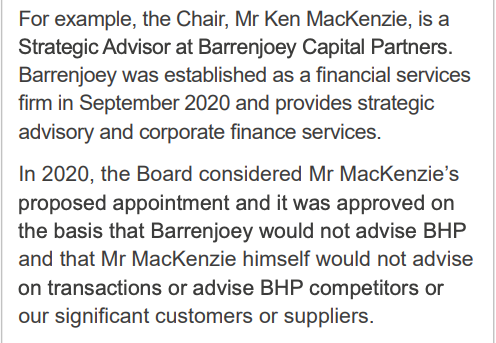

Independence

Define the different types of directors and levels of independence.

- Executive board members: board members who have full-time (usually C-level) positions within the company;

- Nonindependent, nonexecutive board members: board members who do not work full-time for the company but have some other significant link to it;

- Independent nonexecutive board members: board members who do not have a material or financial relationship with the company or related persons, whose role is to provide independent oversight and external relevant expertise and skills.

If board independence seems compromised and does not meet the criteria for independence in their jurisdiction, you might need to justify a member or members’ inclusion.

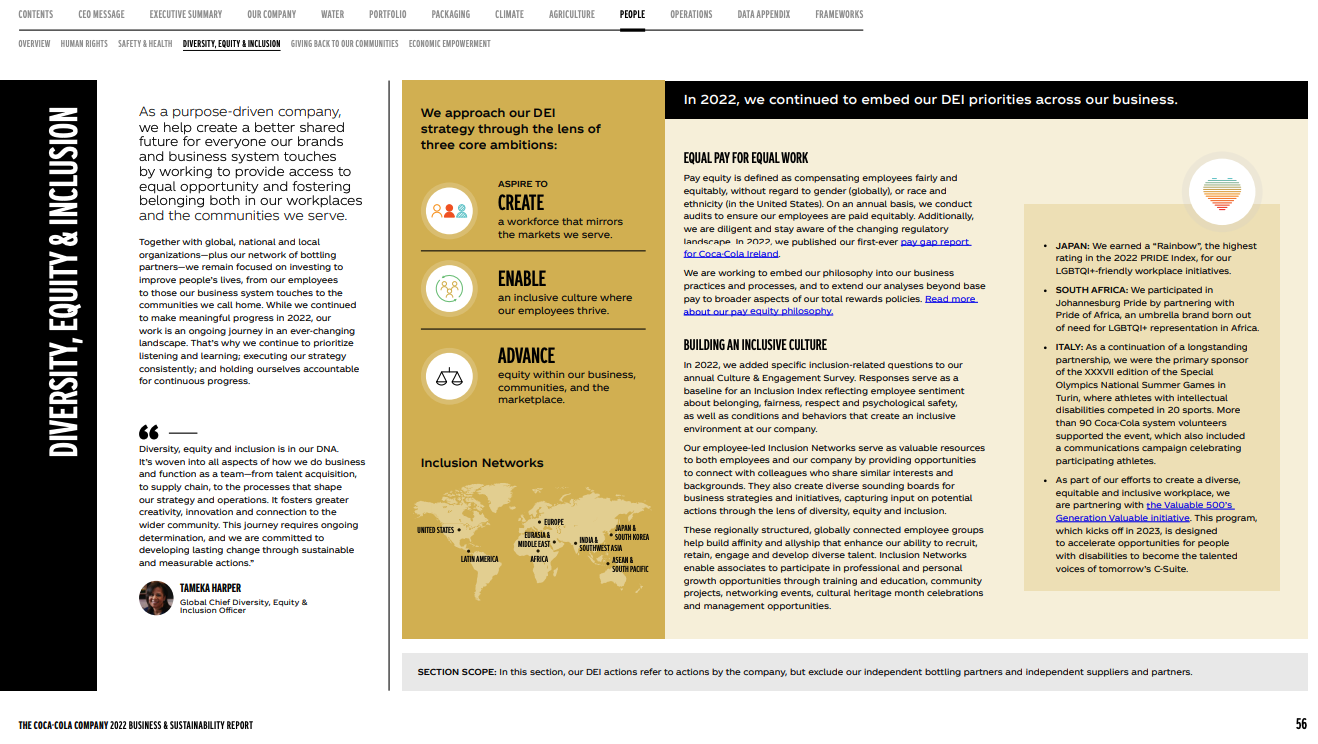

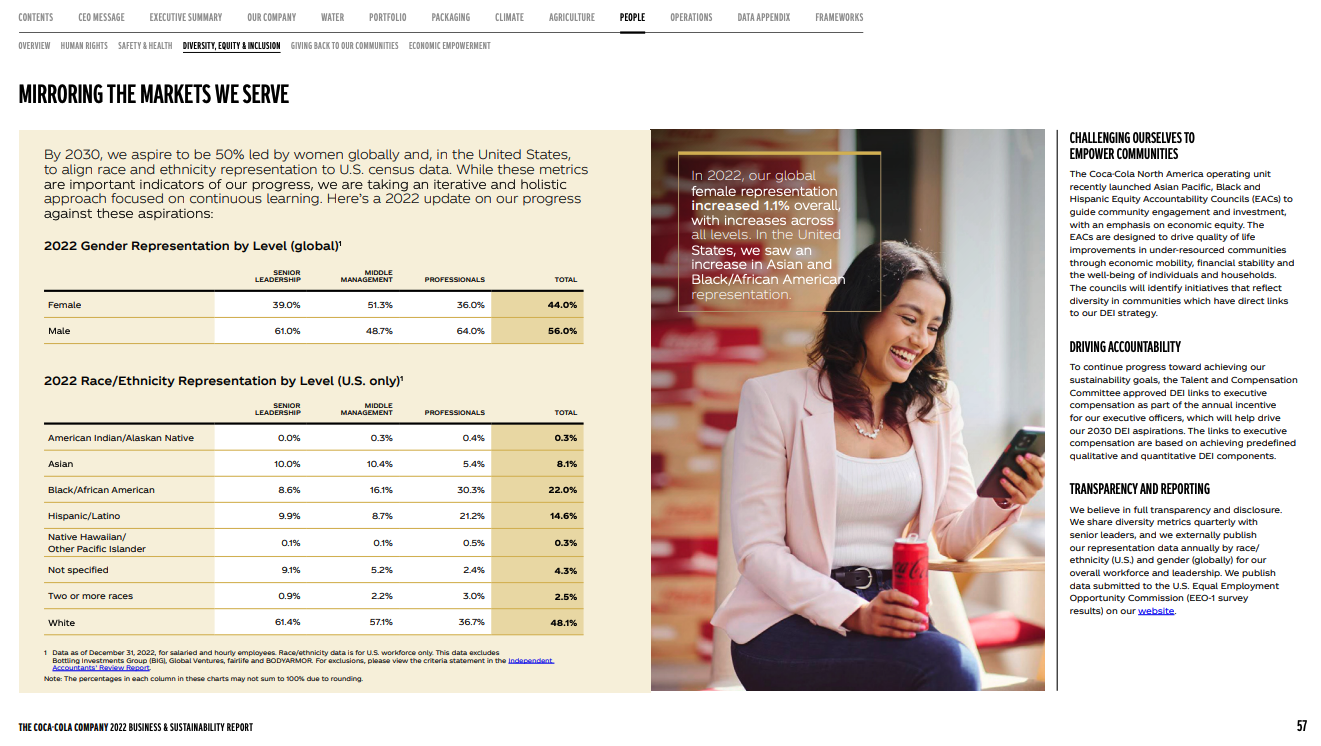

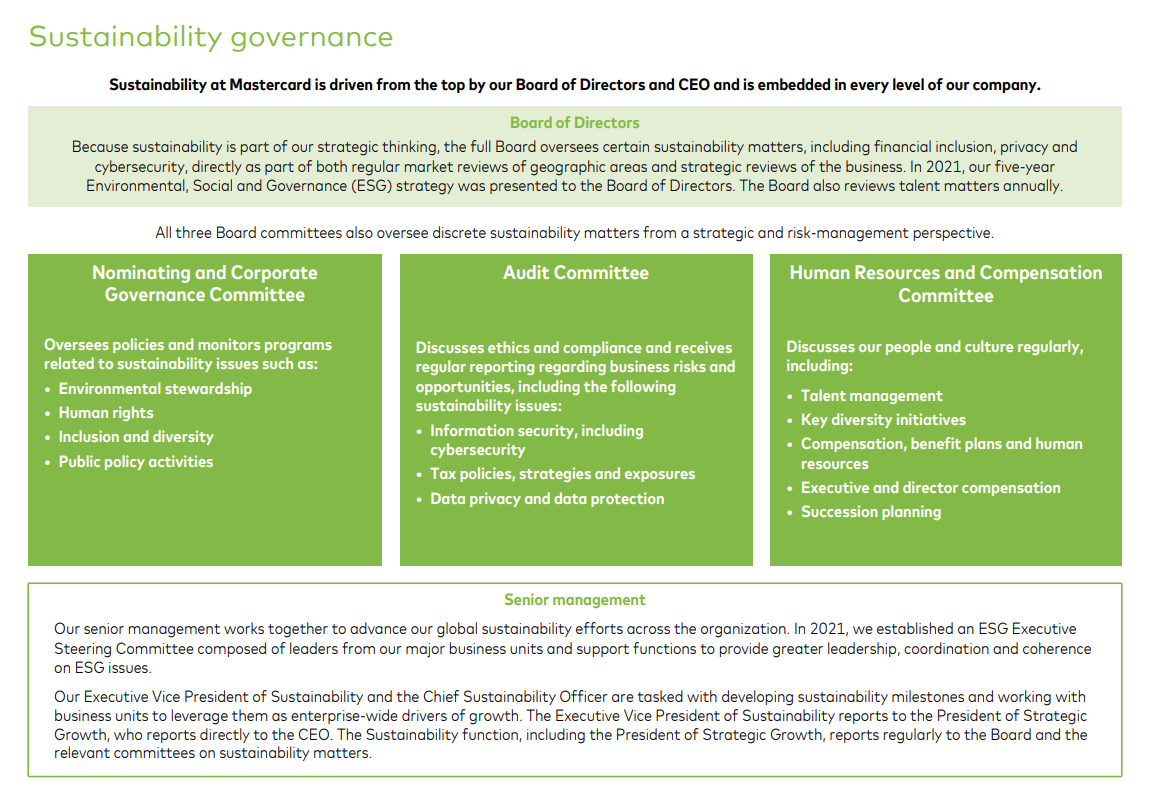

Diversity, Equity, and Inclusion

Boards are increasingly expected to achieve better gender balance and draw from a wider pool of potential candidates. Besides gender, diversity can include candidates of different ages, ethnicities, and other differences in background, including relevant experience or expertise. Explain how recent board nominations considered diversity and any board policy in this area. Research has shown that diversity and inclusion bring a mix of perspectives to the board and management and lead to higher levels of innovation and productivity in the workplace, aid access to a wider talent pool, and improve employee.

Roles and Responsibilities

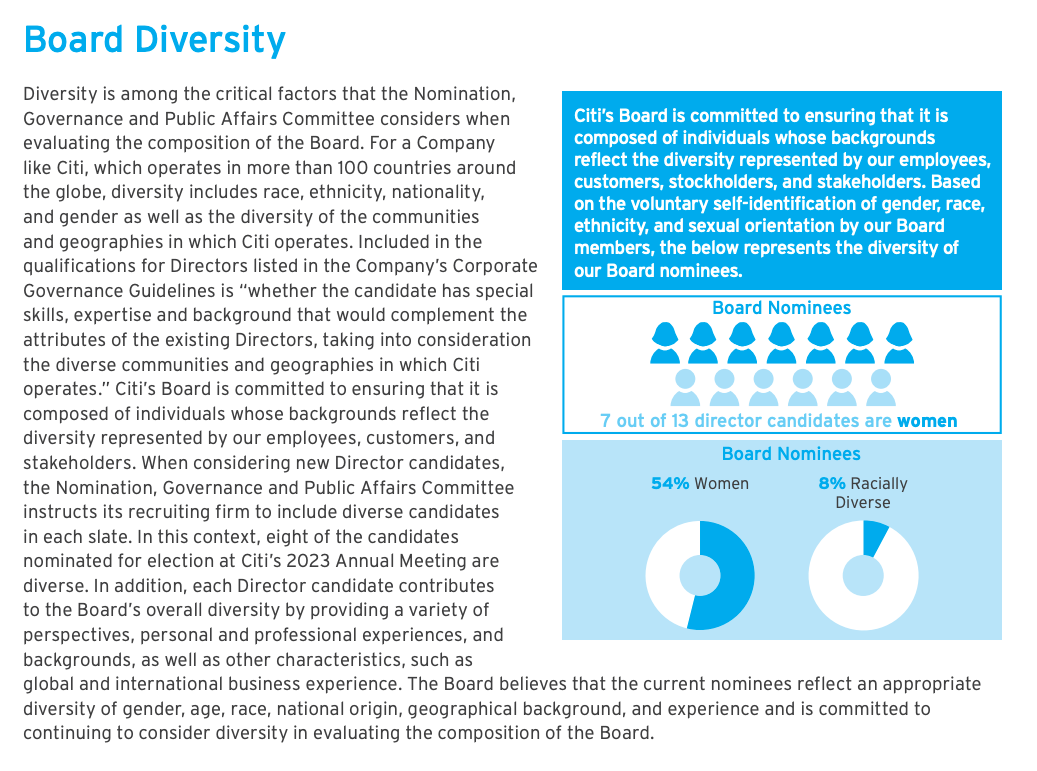

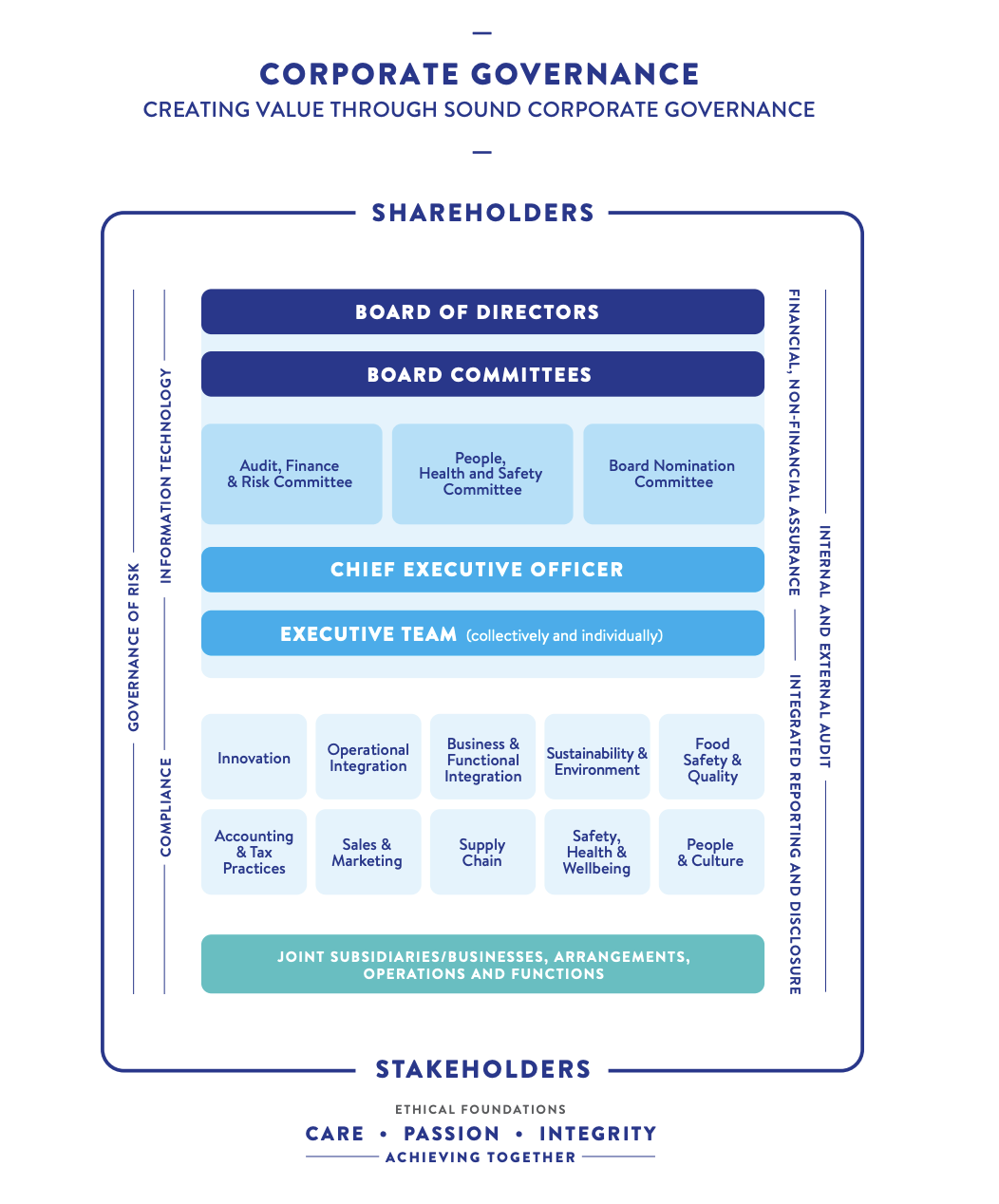

Describe the board’s main activities, especially how it governs and is structured for and oversees sustainability strategy, policies, and plans. Explain the board’s and its committees’ major responsibilities and decisions, and include a link to where committee charters are disclosed on the company’s website. Also describe the division of responsibilities between the board and senior management, including whether executives are also members of the board. Because it is a relatively new focus of governance, clearly explain the board’s and management’s responsibilities regarding sustainability and climate and how the board incorporates climate change actions into its operations and decisions.

Board Committees

Describe the specialized committees that support specific board activities.

- The types of committees (audit, risk, finance, nomination, compensation, governance, sustainability, and risk);

- Committees’ roles (including communication with the board);

- Committees’ composition (including independence and qualifications);

- A website link to the committees’ charters.

Include a review of each committee’s work, highlighting important focus areas.

International Good Practice

A majority of audit committee members should be experienced in managing risk, and all committee members should be independent.

A growing leadership practice is to disclose how board committees oversee sustainability matters and how boards work with management on sustainability issues.

Survey: Primary Committees Responsible for ESG Governance in the S&P 500

Deloitte used the following graphs to present its findings on board committees with primary responsibility for ESG oversight in 2021–22. Most of the S&P 500 companies reporting on governance relied on nominating and governance committees for board oversight of ESG. Note that 31 percent of energy resources and industries relied on ESG and sustainability committees to strengthen board oversight of ESG and climate matters.

Note: The figure is based on Deloitte proxy research on 190 S&P 500 companies reporting on governance in 2021–22.

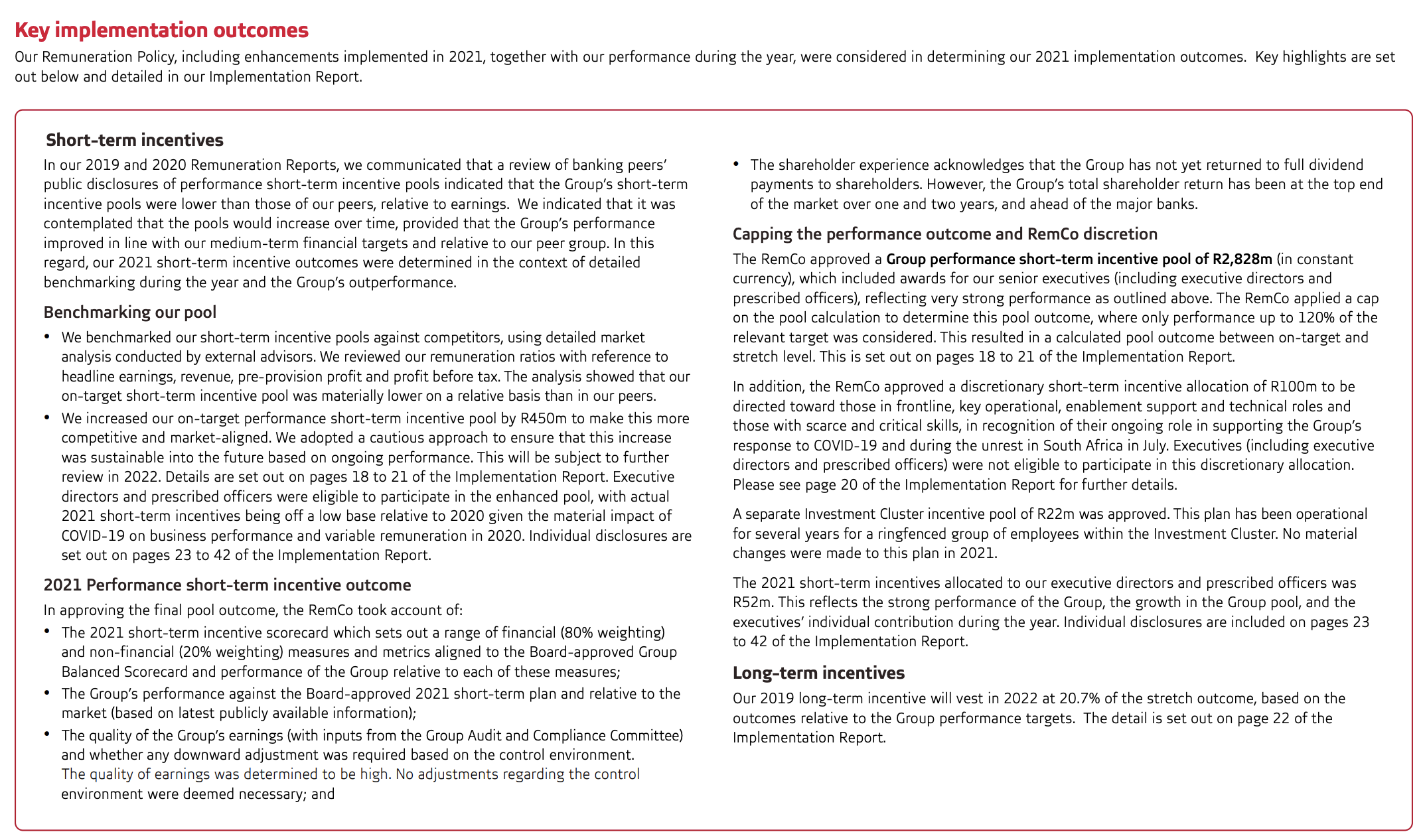

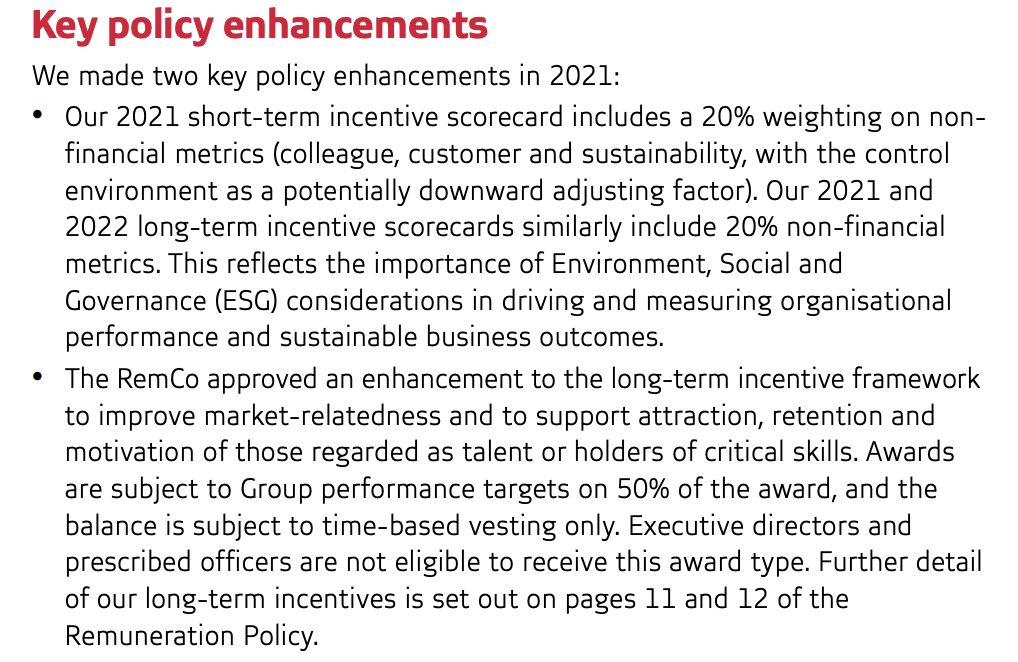

The report describes the company’s policy on executive remuneration and, when applicable, details on pay-for-performance plans, including the areas of performance (financial, operational, sustainability) and whether compensation is delayed or conditional or subject to clawback (recovery of money already disbursed).

The company shall disclose information about the integration of its sustainability-related performance in incentive schemes in the report.

The report describes the process to establish the remuneration policy and the role of the board (or specialized committee) and shareholders in reviewing and approving executive compensation. It also discloses key characteristics of the incentive schemes, the sustainability-related targets and metrics and any discretion used in setting actual remuneration. With the volume of pending legislation and increased reporting demands, companies are starting to link compensation programs to ESG targets.

The report contains actual remuneration data in tabular form for each board member, the chief executive officer, and other key executives. The table should include the following:

- Salary;

- Cash bonuses;

- Stock and stock-based awards;

- Pension accrual;

- The proportion of variable remuneration dependent on sustainability-related targets;

- Other monetary and in-kind benefits.

Delayed compensation (share-based, for example) should be accounted for when granted, noting when the award vests. Conditional compensation (based on future conditions) is not included in compensation totals, but it should be indicated in the supporting information.

-

To guide companies in developing sustainable compensation programs, the Harvard Business Review provides five practical questions:

What does the organization aim to achieve with its compensation plan? How do these objectives link to the corporation’s purpose and strategy?

-

Which metrics matter?

Next, organizations should determine which ESG metrics matter and which don’t. For example, reduction of greenhouse gas emissions is positive and is possibly on everyone’s agenda. But if you’re in the financial services industry, reduction of greenhouse gas emissions of your own premises will have a limited impact, whereas reduction of emissions related to your investment and/or loan portfolios would be more impactful. Such materiality is a key issue for the relation between ESG and business performance.

-

How do you weight the incentives and over what timeframe?

Once materiality is assessed, it’s important to determine priorities, or the weighting, of incentive plan metrics to drive the right behaviors. To make an impact, compensation plans need to be tied to clear key performance indicators and be financially meaningful to participants.

-

What are the targets?

For incentivization purposes, sustainability key performance indicators must be measurable and typically set with reference to external standards or international treaties (like the Paris Agreement). As regulations and standards continue to evolve, so too will the ESG metrics that are selected. Boards therefore need to make sure that they measure what matters and allow for discretionary adjustments where needed.

-

How will you show progress?

With ESG metrics in place to incentivize executive focus, disciplined disclosure practices play a vital role in providing visibility on the progress being made. Compensation-linked targets should be auditable and be disclosed following, where possible, the existing disclosure standards.

Source: Martha Cook, Katherine Savage, and Frederic Barge. 2023. “Linking Executive Pay to Sustainability Goals.” Harvard Business Review, February 7, 2023. https://hbr.org/2023/02/linking-executive-pay-to-sustainability-goals

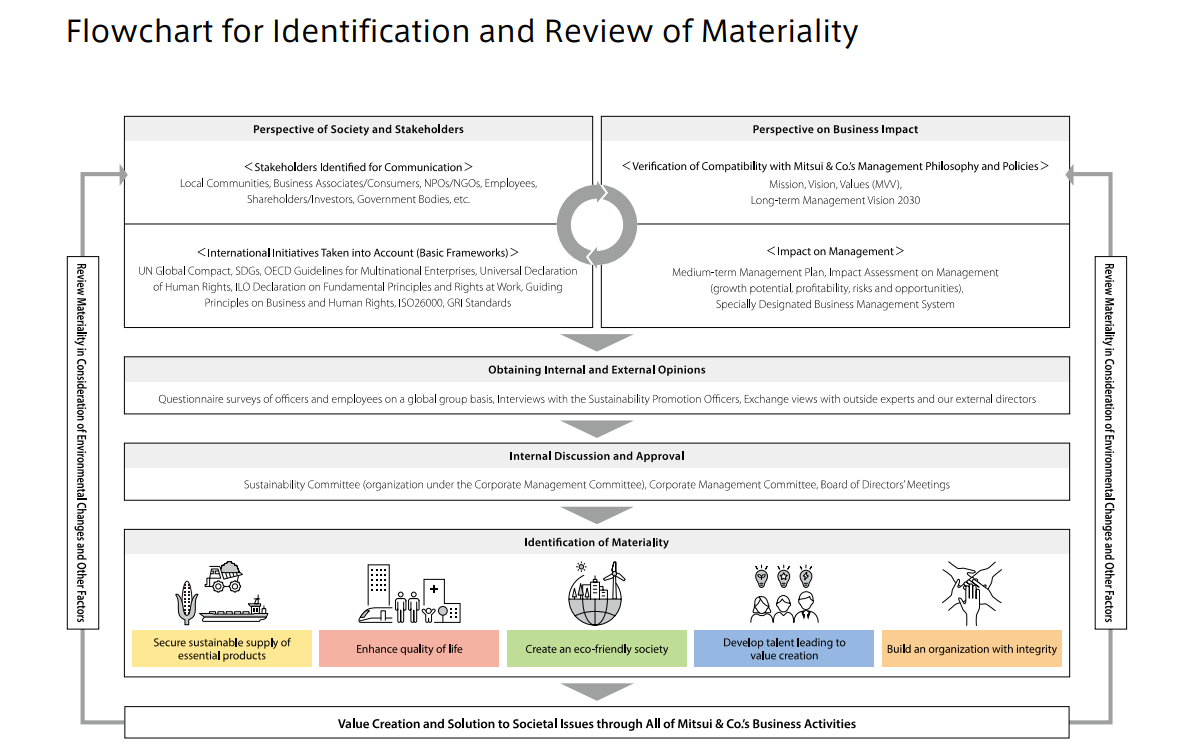

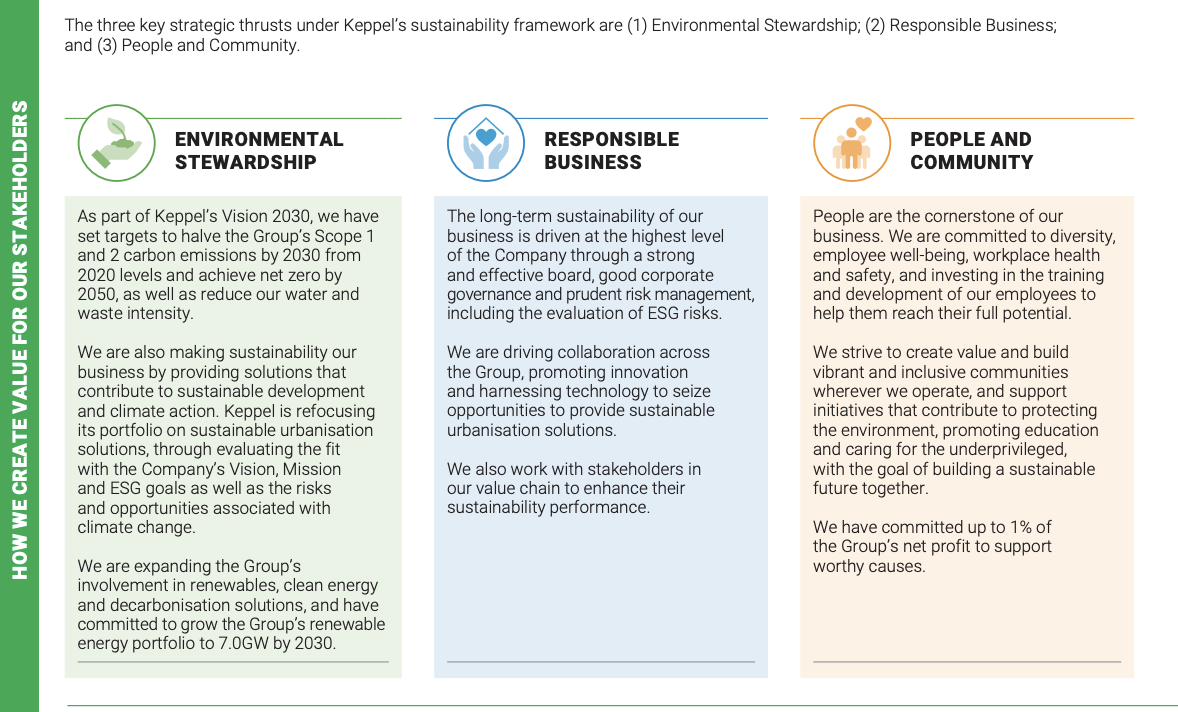

Describe the structure and processes for ensuring that ESG issues are reviewed and addressed periodically. This may include the following:

- Oversight of sustainability issues at the board level;

- Oversight coordinated among the corporate governance, risk, and audit committees;

- Oversight by a stand-alone committee or subcommittee dedicated to sustainability.

Increasingly, a stand-alone committee of the board led by an independent director is responsible for ESG and sustainability matters. The following diagram suggests some typical activities of a sustainability committee. A study of Financial Times Stock Exchange 100 firms shows that 54 percent of these companies have a stand-alone ESG and sustainability committee at the board level.

The International Financial Reporting Standards (IFRS) Standard S1, General Requirements for Disclosure of Sustainability-Related Financial Information, includes governance as one of four pillars for sustainability disclosure.

-

ISSB IFRS S1 General Requirements For Disclosure Of Sustainability-Related Financial Information

GOVERNANCE

26 The objective of sustainability-related financial disclosures on governance is to enable users of general purpose financial reports to understand the governance processes, controls and procedures an entity uses to monitor, manage and oversee sustainability-related risks and opportunities.

27 To achieve this objective, an entity shall disclose information about:

(a) the governance body(s) (which can include a board, committee or equivalent body charged with governance) or individual(s) responsible for oversight of sustainability-related risks and opportunities. Specifically, the entity shall identify that body(s) or individual(s) and disclose information about:

(i) how responsibilities for sustainability-related risks and opportunities are reflected in the terms of reference, mandates, role descriptions and other related policies applicable to that body(s) or individual(s);

(ii) how the body(s) or individual(s) determines whether appropriate skills and competencies are available or will be developed to oversee strategies designed to respond to sustainability-related risks and opportunities;

(iii) how and how often the body(s) or individual(s) is informed about sustainability-related risks and opportunities;

(iv) how the body(s) or individual(s) takes into account sustainability-related risks and opportunities when overseeing the entity’s strategy, its decisions on major transactions and its risk management processes and related policies, including whether the body(s) or individual(s) has considered trade-offs associated with those risks and opportunities; and

(v) how the body(s) or individual(s) oversees the setting of targets related to sustainability-related risks and opportunities, and monitors progress towards those targets (see paragraph 51), including whether and how related performance metrics are included in remuneration policies.

(b) management’s role in the governance processes, controls and procedures used to monitor, manage and oversee sustainability-related risks and opportunities, including information about:

(i) whether the role is delegated to a specific management-level position or management-level committee and how oversight is exercised over that position or committee; and

(ii) whether management uses controls and procedures to support the oversight of sustainability-related risks and opportunities and, if so, how these controls and procedures are integrated with other internal functions.

Source: ISSB IFRS S1 General Requirements for Disclosure of Sustainability-related Financial Information.

Focus 15: Sustainability Committees: Structure and Practices

This International Finance Corporation paper proposes the sustainability committee as a mechanism for managing and governing sustainability and provides guidance on this issue to directors and senior managers. It draws from good practice examples of sustainability committees in both developed and emerging markets.

Download: Focus 15: Sustainability Committees: Structure and Practices

Describe the annual evaluation processes of the whole board, individual board members, and each board committee and include the following:

- A description of the process (including frequency and who conducts the evaluation);

- Key indicators on which the evaluation was based;

- Results and areas that need improvement;

- Action plan based on the results;

- Actions taken after the previous board evaluation.

Leadership Practices

Evaluations of the board and its committees should be undertaken annually, and an independent third party should conduct the evaluation once every three years. Board evaluation should link to succession planning for the board and senior management.

Include a description in the annual report of management’s role in assessing and managing sustainability-related risks and opportunities, including whether that role is delegated to a specific management-level position or committee and how oversight is exercised over that position or committee. Include information about whether dedicated controls and procedures are applied to management of sustainability-related risks and opportunities and if so, how they are integrated with other internal functions.