What do investors want to know?

The ISSB’s strategy pillar recommends that companies disclose the actual and potential impacts of climate-related risks and opportunities on the organization’s businesses, strategy, and financial planning, where such information is material.

- Alignment of a company’s underlying future vision with its business model.

- Risks and opportunities recognized through scenario analysis and processes to incorporate them into the company’s strategy and financial plans.

What additional elements do stakeholders want to know?

In addition to the above, stakeholders beyond the average investor may also want to understand the company’s impacts on climate change better. For example, European Sustainability Reporting Standard E1 Climate Change provides an additional requirement to disclose the policies that the company has in place to mitigate its material impacts related to climate change mitigation and adaptation.

For the sixth year in a row, the World Economic Forum identified that environmental risks, including failure to mitigate climate change, extreme weather, and natural disasters, as the top global risks for the short (2 years) and long-term (10 years).

The private sector has a fundamental role to play because it is exposed to different physical and transition risks as a result of climate change, and therefore it must embrace the climate agenda by strengthening its sustainability and climate practices and disclosure.

There is growing investor interest in companies engaged in sustainable business activities. Investors want to understand how companies tackle issues such as climate change, gender diversity or supply chain risks that may have a material impact on their business. Standard-setters are developing new disclosure standards for climate-related financial information.

Regulators and stock exchanges are implementing climate disclosure requirements and listing rules, as well as developing guidance and training to improve corporate disclosure in this area.

Reporting of climate-related risks and opportunities not only provides investors with the data they require, but it also offers listed and non-listed companies with external and internal benefits. These may include better risk management, lower cost of capital and lower energy costs.

To prepare for disclosure on climate-related financial risks and opportunities, a business must assess its governance, processes and performance. This exercise, alongside with the benefits of disclosure itself, offer a number of internal and external benefits:

The benefits of climate-related financial disclosure for companies

This section describes the disclosure of climate-related financial information of the Governance pillar of the Task Force for Climate-related Financial Information (TCFD).

-

Task Force for Climate-related Financial Disclosure

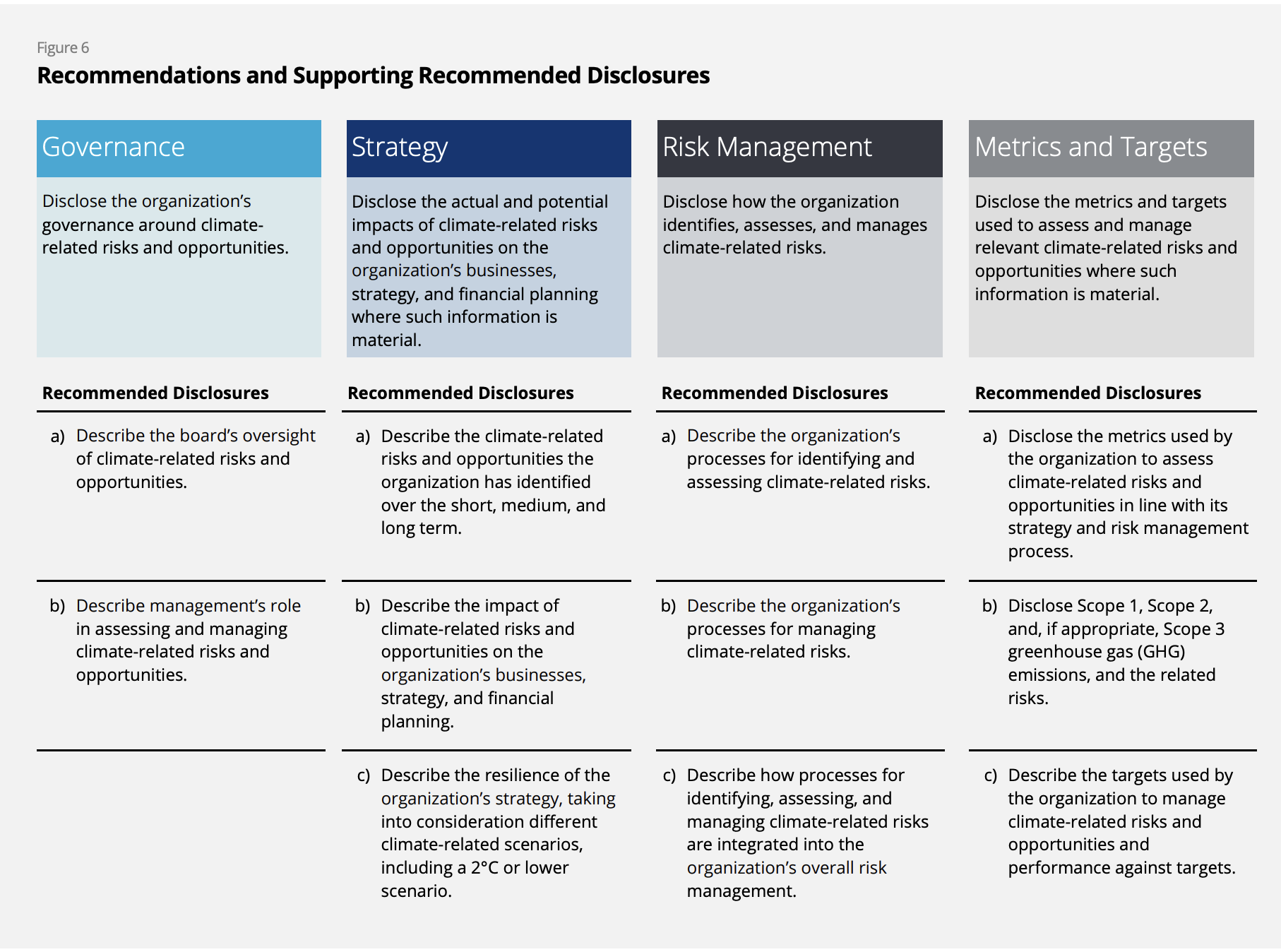

The recommendations of the Task Force for Climate-Related Financial Disclosure (TCFD) recommendations were launched in 2017 “to help identify the information needed by investors, lenders, and insurance underwriters to appropriately assess and price climate-related risks and opportunities.” The TCFD Recommendations comprise of four core elements:

- Governance

- Strategy

- Risk Management

- Metrics and Targets

More than 3,800 companies provided TCFD reports as of October 2022. The recommendations were intended for voluntary implementation, but they are increasingly becoming mandatory in markets such as Brazil, Japan, Singapore, Switzerland, the United Kingdom, and others.

The climate-related and general sustainability-related disclosure standard of the International Sustainability Standards Board (ISSB) marked the culmination of the TCFD and the ISSB has now taken over responsibility for monitoring progress of companies’ climate-related disclosures from the TCFD.

For additional resources on TCFD, visit the TCFD Knowledge Hub, see the TCFD’s final status report and the TCFD publications web page.

-

International Sustainability Standards Board

The International Sustainability Standards Board (ISSB) is is an independent, private-sector body that develops —in the public interest— standards that will result in a high-quality, comprehensive global baseline of sustainability disclosures focused on the needs of investors and the financial markets.

International Financial Reporting Standard (IFRS) S1 General Requirements for Disclosure of Sustainability-Related Financial Information provide the conceptual foundations and core content for reporting all sustainability-related financial information, while IFRS S2 Climate-Related Disclosures provides climate specific requirements within the foundations of IFRS S1. The standards are to be applied as of January 1, 2024. The ISSB's standards focus on sustainability-relayed risks and opportunities that are material for investors and are largely build on the TCFD Recommendations and as such, implementing the IFRS Sustainability Disclosure Standards also fulfills means that a company has implemented the TCFD Recommendations.

A few major jurisdictions are expected to adopt the standards and that that will gradually replace the TCFD reporting. Until then, the ISSB encourages companies to apply the IFRS Sustainability Disclosure Standards on a voluntary basis.

IFRS S1 General Requirements for Disclosure of Sustainability-related Financial Information

IFRS S2 Climate-related Disclosures.For additional resources on the IFRS Sustainability Disclosure Standards, visit the IFRS Sustainability Knowledge Hub.

-

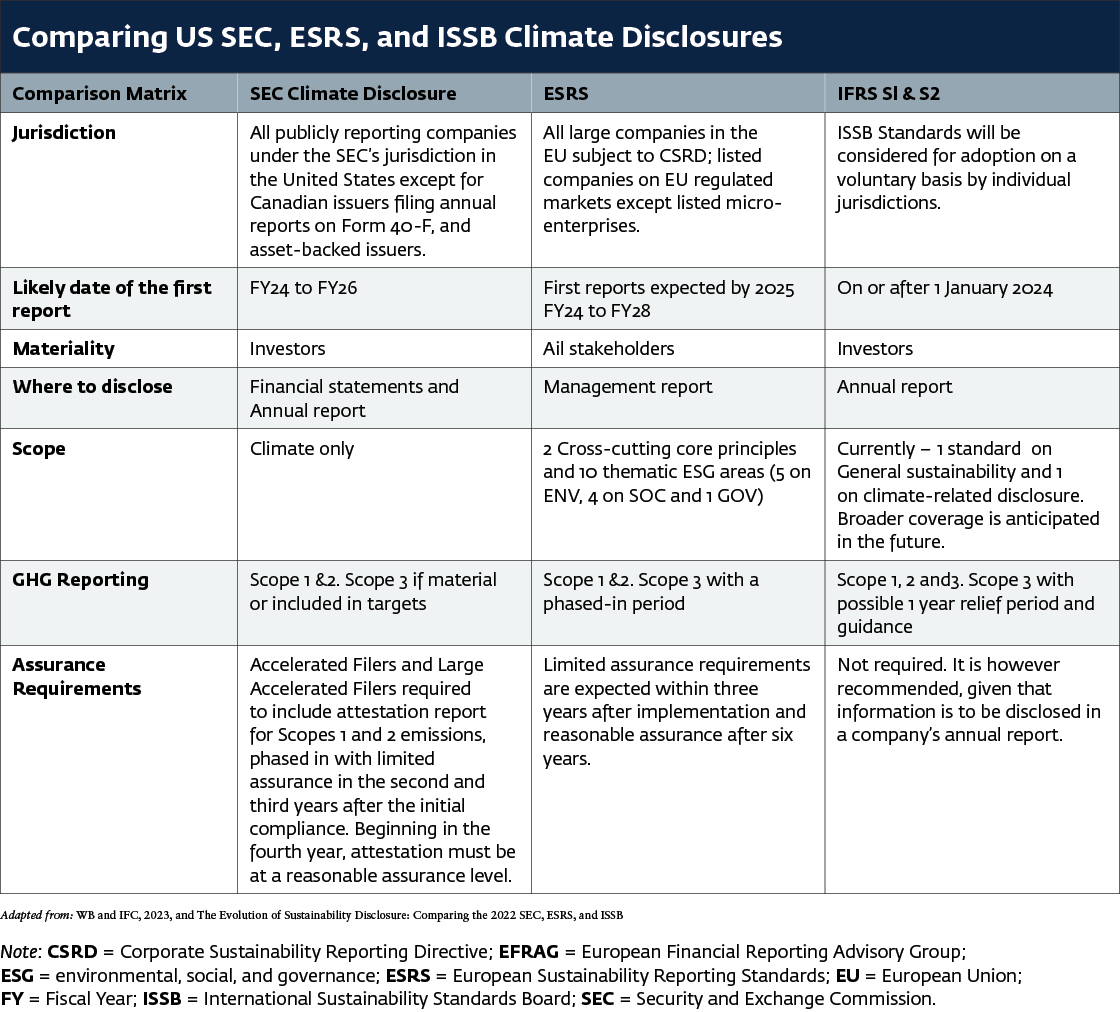

European Sustainability Reporting Standards

On January 5, 2023, the European Union Corporate Sustainability Reporting Directive (CSRD) entered into force, affecting more than 50,000 companies in Europe and more than 10,000 outside of Europe. Companies subject to the CSRD must report according to the European Sustainability Reporting Standards (ESRS), including two cross-cutting standards on the general principles and requirements for reporting and detailed requirements on 10 topics across environment (five), social (four), and governance (one) to be applied to companies as of January 1, 2024.

-

US Securities and Exchange Commission Climate-Related Disclosures

In March 2022, the US Securities and Exchange Commission (US SEC) proposed climate-related disclosure requirements that would require public companies to provide climate-related financial data and greenhouse gas emissions insights in public disclosure filings. As part of the draft rule, companies have to disclose emissions for which they are directly responsible and emissions from their supply chains and products. This aligns the US SEC approach more closely with the ISSB. Additionally, in May 2022, the US SEC proposed two new rules aiming to decrease unfounded claims by funds about their environmental, social, and governance (ESG) credentials and to create more standardization regarding ESG disclosures by certain investment advisors and investment companies.

US SEC Press Release regarding the draft Climate-Related Disclosure by the US SEC

-

CDP

CDP, created in 2000, is a nonprofit organization that runs the global disclosure system for investors, companies, cities, states, and regions to manage their environmental impacts. More than 20,000 companies worldwide complete CDP’s questionnaire on climate, water, and forests. The CDP questionnaire is aligned with TCFD. CDP will incorporate ISSB climate-related disclosure standards into global environmental disclosure platform.

Learn more about CDP

-

Comparing US SEC, ESRS, and ISSB Climate Disclosures

Comparison studies used for the table above:

- The Evolution of Sustainability Disclosure: Comparing the 2022 SEC, ESRS, and ISSB Proposals;

- Reconciliation tale Draft European Sustainability Reporting Standards, Appendix V: IFRS Sustainability Standards and ESRS Reconciliation Table (ESRS E1 versus IFRS S2, pages 54–73);

- Comparison ISSB IFRS S2 Climate-Related Disclosures with the TCFD Recommendations;

- GRI and the European Sustainability Reporting Standards (ESRS): Q&A.

TCFD Recommendations are structured around four core elements or pillars: governance, strategy, risk management, and metrics and targets. These are not designed to be considered linearly because they are interconnected and should be seen together as part of a holistic picture. For example, it would be appropriate to see risk management disclosures and some governance disclosures together to demonstrate how risks are governed within an organization. Furthermore, this information should be connected to the financial statements of the company. For example, expenditure on research & development to manage a risk, or take advantage of an opportunity.

The four pillars of governance, strategy, risk management, and metrics and targets are the basis of the IFRS Sustainability Disclosure Standards and the European Sustainability Reporting Standards (ESRS).

The IFRS Foundation’s International Sustainability Standards Board (ISSB) takes over responsibility for monitoring progress of companies’ climate-related disclosures from the Financial Stability Board’s (FSB) Task Force on Climate-related Financial Disclosures (TCFD) as of January 2024.

In practice, this means that companies applying ISSB IFRS S1 and IFRS S2 will meet the TCFD recommendations as the recommendations are fully incorporated into the IFRS Sustainability Disclosure Standards. The ISSB Standards' requirements however go beyond TCFD recommendations. IFRS S2 is provides more detailed requirements (see a comparison here), while IFRS S1 provides a basis to go beyond reporting on climate and report on all sustainability-related financial information.

According to the ISSB’s announcement, companies can continue to use the TCFD recommendations should they choose to do so, and some companies may still be required to use the TCFD recommendations.

The recommendations should be used to integrate financial disclosures related to climate risks and opportunities into a company’s mainstream financial filings or annual report. They were developed with high-risk sectors and financial sector companies in mind, with advanced guidance for these sectors, but all sectors can use them.

Eleven recommendations underpin the four pillars (see the following table).

The TCFD provides a phased approach for the disclosure of the 11 recommendations. Companies do not need to start with disclosure to all recommendations. Phase 1 recommends disclosures related to the governance and risk management pillars.

For additional resources on TCFD, visit the TCFD Knowledge Hub and the TCFD publications web page.

For more resources for banks, visit the United Nations Environment Programme Finance Initiative TCFD Banking Pilot Projects web page.

See company reports that include TCFD-related disclosures on the TCFD Report Database web page.

Watch recordings of the United Nations Sustainable Stock Exchanges Initiative, International Finance Corporation, and CDP Worldwide training on TCFD, “TCFD—Climate Disclosure Training.”

For guidance on climate disclosure, see the UN Sustainable Stock Exchanges Initiative’s Model Guidance on Climate Disclosure: A Template for Stock Exchanges to Guide Issuers on TCFD Implementation.

TCFD’s strategy pillar recommends that companies disclose the actual and potential impacts of climate-related risks and opportunities on the organization’s businesses, strategy, and financial planning, where such information is material.

What do investors want to know?

- Alignment of a company’s underlying future vision with its business model

- Risks and opportunities recognized through scenario analysis and processes to incorporate them into the company’s strategy and financial plans.

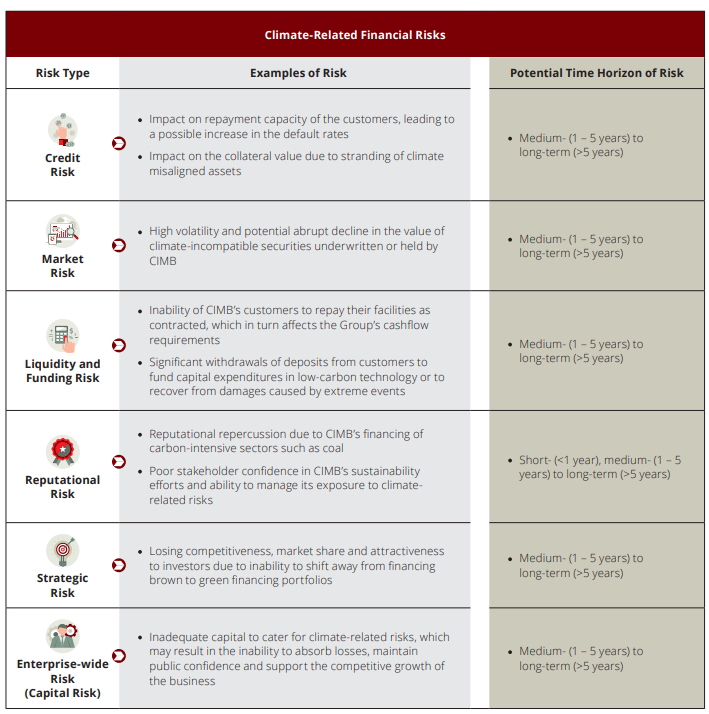

Describe the climate-related risks and opportunities the organization has identified over the short, medium, and long term.

Consider including a discussion of:

- What do you mean by short-, medium- and long-term?

- What material opportunities and risks have you identified for each?

- What process(es) have you used to determine whether they will have a financial impact on your organization?

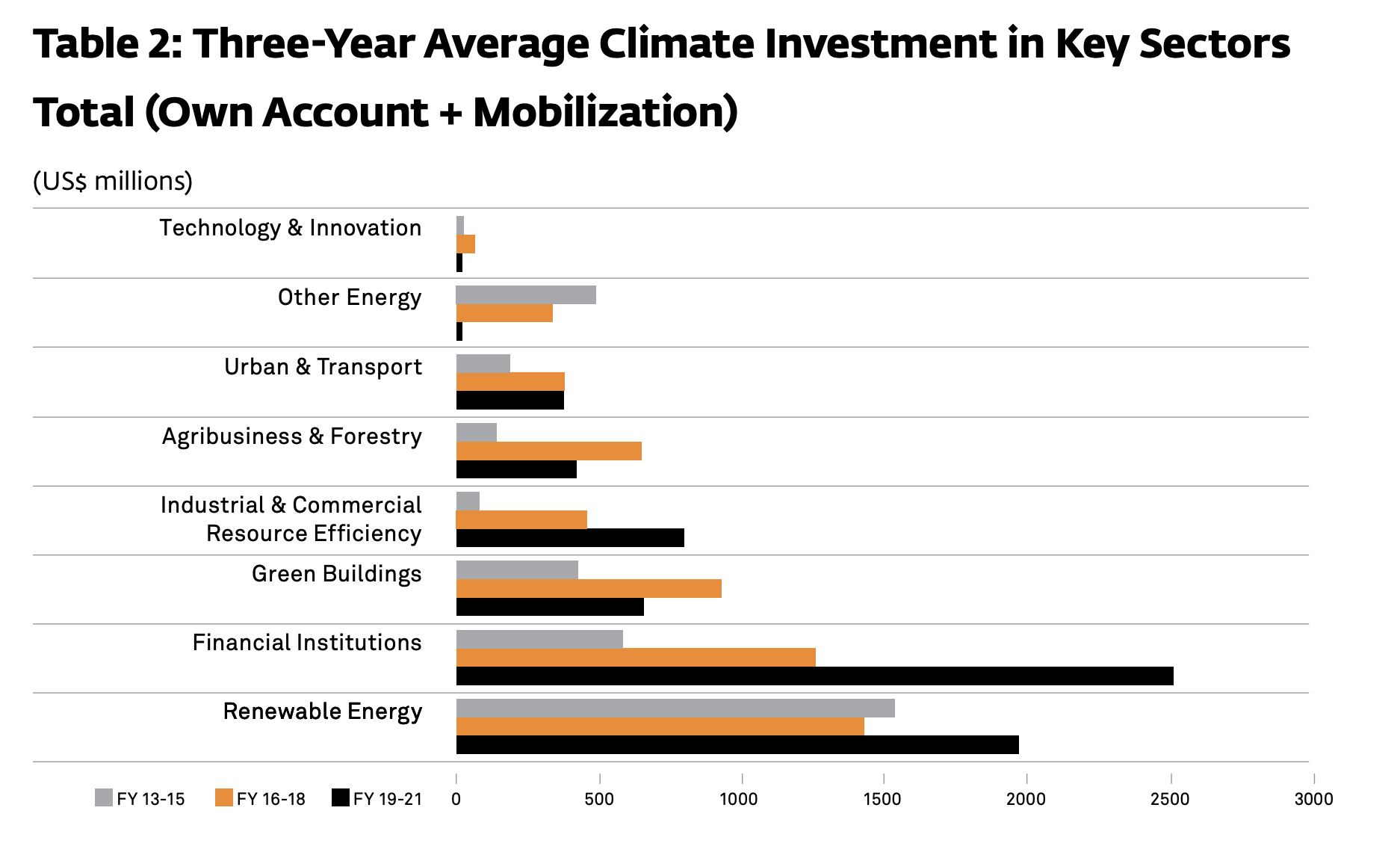

Describe the impact of climate-related risks and opportunities on the organization’s businesses, strategy, and financial planning.

Consider including a discussion of:

- Products and services

- Supply chain and/or value chain

- Adaptation and mitigation activities

- Investment in research and development

- Operations (including types of operations and location of facilities)

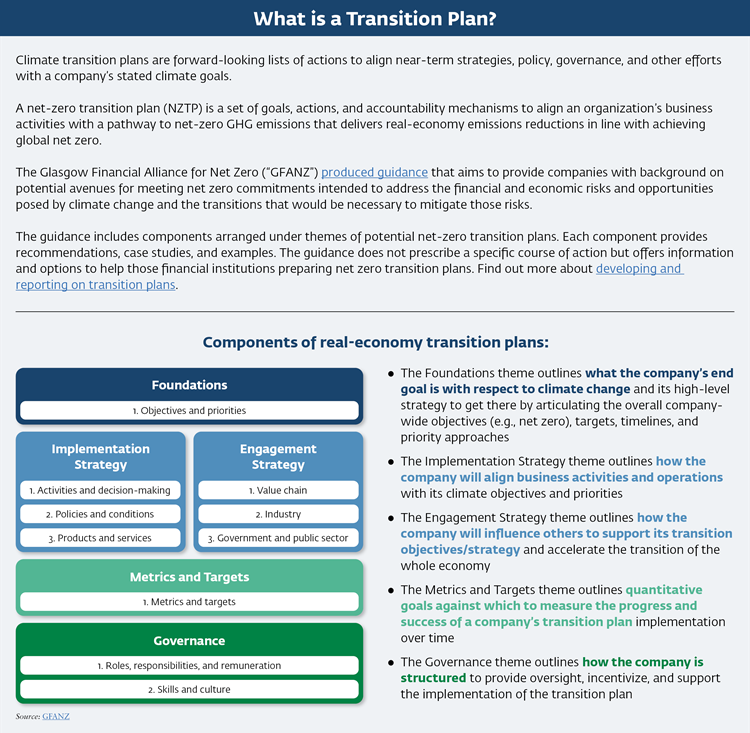

As a response to the impacts of climate-related risks and opportunities reported, consider developing a climate-related transition plan and disclosing it in your report.

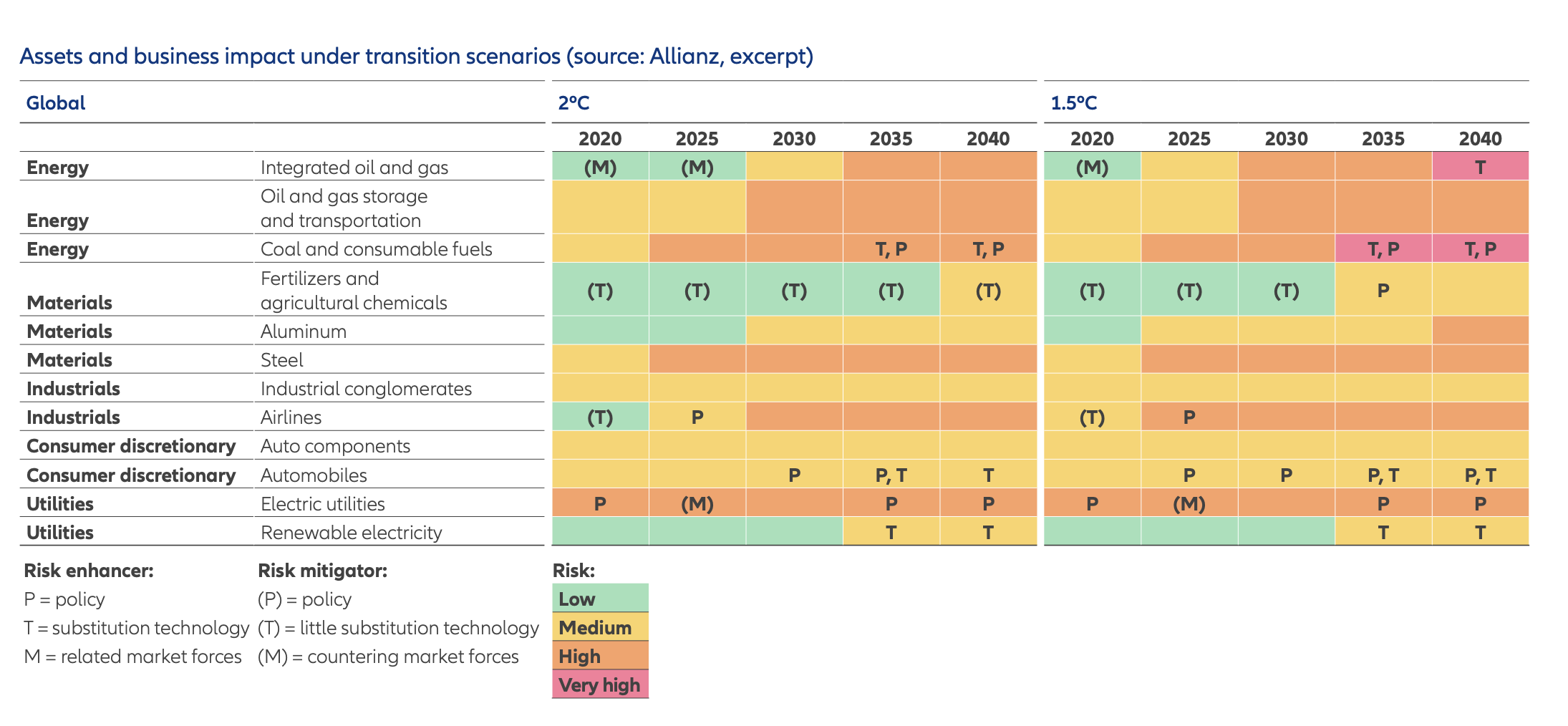

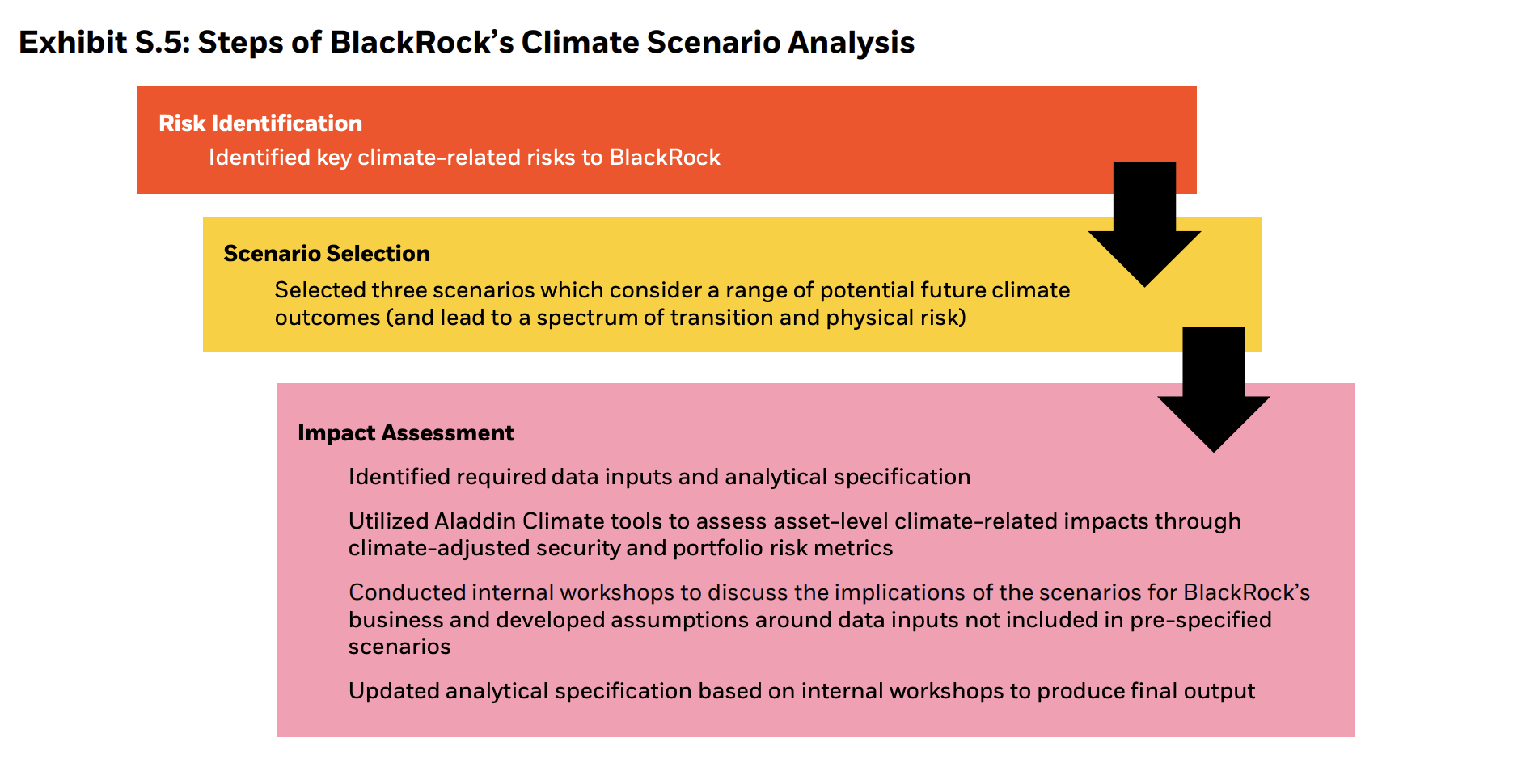

Disclose the resilience of the organization’s strategy, taking into consideration different climate-related scenarios, including a 2°C or lower scenario.

Consider including a discussion of:

- Have you used climate-related scenarios to inform the business strategy and financial planning?

- What are the climate-related scenarios and associated time horizon(s) considered?

- What are the implications of different policy assumptions, macro-economic trends, energy pathways, and technology assumptions used in climate-related scenarios to assess the resilience of the organization’s strategies?

What is scenario analysis?

A method for developing strategic plans that are more flexible or robust to a range of plausible future states.

- Explore alternatives that may significantly alter the basis for “business-as-usual” assumptions.

- A scenario describes a pathway of development leading to a particular plausible (but not necessarily ‘desirable’) outcome.

- Scenario analysis is a tool to enhance critical strategic thinking and should be understood as narratives based on multiple scenarios.

- What is important is not credibility of the results of analysis, but the responses to the expected futures.

- Scenario analysis is not a prediction of future performance.

Like TCFD reporting, scenario analysis is a journey. It takes three to five years for a company to progress from narrative scenarios with potential climate implications to sophisticated quantitative models and data sets. The most used scenario analysis are the Intergovernmental Panel on Climate Change Emission Scenarios and International Energy Agency scenarios.

Guidance on Scenario Analysis for Nonfinancial Companies, by TCFD (2020), provides practical, process-oriented ways for companies to use climate-related scenario analysis and ideas for disclosing the resilience of their strategies for different climate-related scenarios.

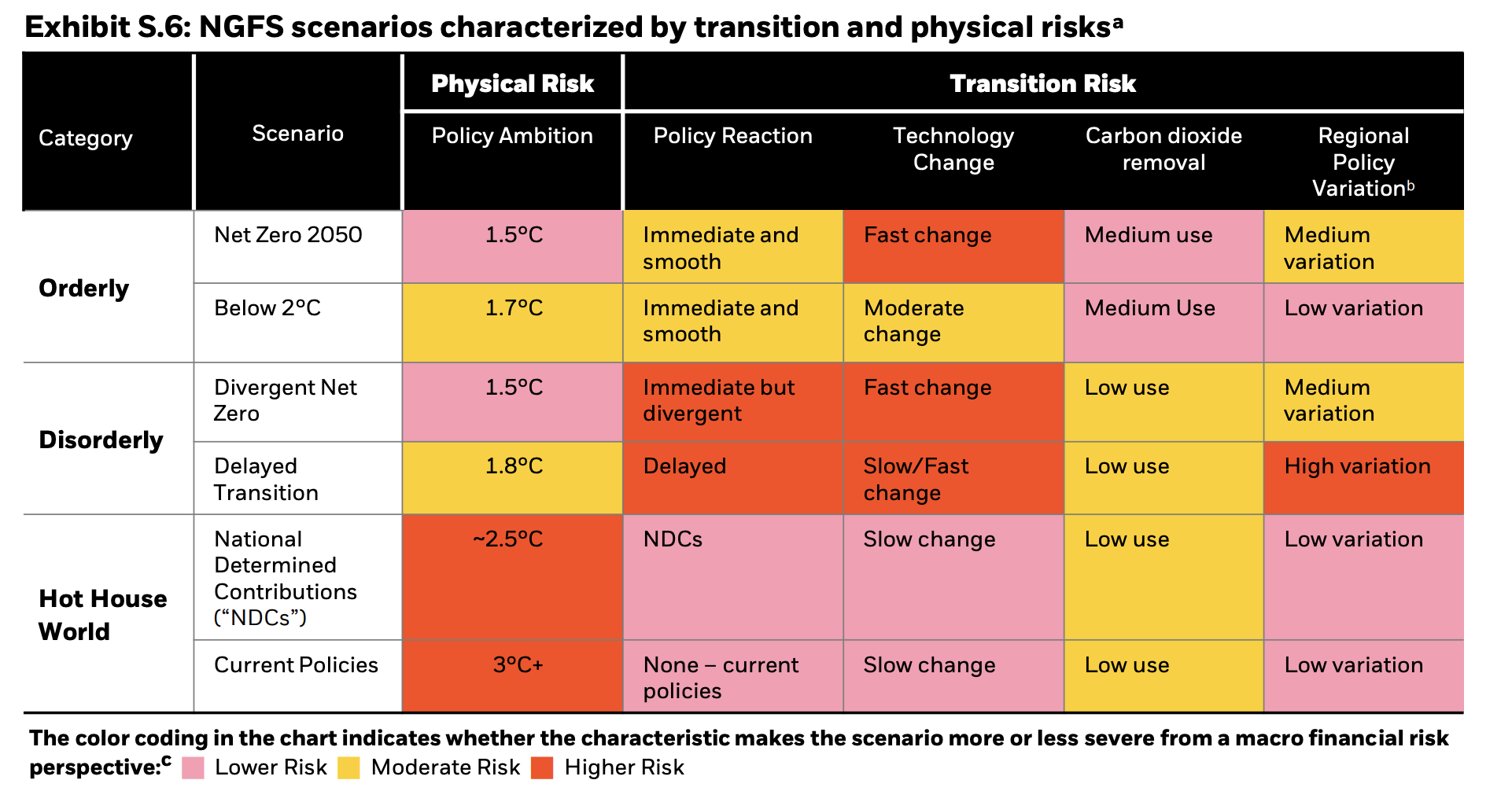

The Network of Central Banks and Supervisors for Greening the Financial System (NGFS) offers four climate scenarios for banks.

Strategy checklist

Top Tips for Getting Started with Disclosure

- Leverage existing processes and disclosures;

- Connect information;

- Cross reference within and across reports (annual, sustainability, TCFD);

- Provide clear, concise, and proportional information;

- Clearly define time horizons (short-, medium-, and long-term);

- Start with qualitative reporting if no data are available;

- Create an internal road map for climate-related disclosures;

- Coordinate with different functions and teams that address climate change.

Creating an Internal Road Map for Climate-Related Disclosures

Where to Disclose Climate-Related Financial Information

- Disclosure should be provided in the mainstream report, also referred to as the annual report, registration document, or 10-K;

- Intention is not for separate TCFD statements or additional sustainability reporting;

- Integrated into reporting and connected to financial information;

- Subject to the same governance processes and sign off as the financial report;

- Accessible to investors as primary users.

International Sustainability Standards Board

The ISSB IFRS S2 Climate-Related Disclosures include disclosures on strategy as one of the four pillars for climate-related financial disclosure (governance, strategy, risk management, and metrics and targets). You should read IFRS S2 together with the IFRS S1 General Requirements for Disclosure of Sustainability-Related Financial Information. This strategy section is aligned with the main recommendations under the strategy pillar of the forthcoming Draft IFRS S2 Climate-Related Disclosures and will help your company prepare for disclosure under the new standards.

-

ISSB IFRS S2 Climate-related Disclosures (Excerpt)

STRATEGY

The objective of climate-related financial disclosures on strategy is to enable users of general purpose financial reports to understand an entity’s strategy for managing climate-related risks and opportunities.

Specifically, an entity shall disclose information to enable users of general purpose financial reports to understand:

- the climate-related risks and opportunities that could reasonably be expected to affect the entity’s prospects (see paragraphs 10–12);

- the current and anticipated effects of those climate-related risks and opportunities on the entity’s business model and value chain (see paragraph 13);

- the effects of those climate-related risks and opportunities on the entity’s strategy and decision-making, including information about its climate-related transition plan (see paragraph 14);

- the effects of those climate-related risks and opportunities on the entity’s financial position, financial performance and cash flows for the reporting period, and their anticipated effects on the entity’s financial position, financial performance and cash flows over the short, medium and long term, taking into consideration how those climate-related risks and opportunities have been factored into the entity’s financial planning (see paragraphs 15–21); and

- the climate resilience of the entity’s strategy and its business model to climate-related changes, developments and uncertainties, taking into consideration the entity’s identified climate-related risks and opportunities (see paragraph 22).

The European Sustainability Reporting Standards contain topic-specific standards on climate change, which companies should implement together with the general disclosures required in the cross-cutting ESRS 2 General, Strategy, Governance, and Materiality Assessment disclosures.

-

European Sustainability Reporting Standards ESRS E1 – Climate Change (Excerpt)

ESRS 2 General disclosures

12. The requirements of this section should be read and applied in conjunction with the disclosures required by ESRS 2 on Chapter 2 Governance, Chapter 3 Strategy and Chapter 4 Impact, risk and opportunity management. The resulting disclosures shall be presented in the sustainability statement alongside the disclosures required by ESRS 2, except for ESRS 2 SBM-3 Material impacts, risks and opportunities and their interaction with strategy and business model, for which the undertaking may, in accordance with ESRS2 paragraph 46, present the disclosures alongside the other disclosures required in this topical standard.

Disclosure Requirement E1-1 – Transition plan for climate change mitigation

14. The undertaking shall disclose its transition plan for climate change mitigation.

15. The objective of this Disclosure Requirement is to enable an understanding of the

undertaking’s past, current, and future mitigation efforts to ensure that its strategy and

business model are compatible with the transition to a sustainable economy, and with the

limiting of global warming to 1.5 °C in line with the Paris Agreement and with the objective of achieving climate neutrality by 2050 and, where relevant, the undertaking’s exposure to coal, oil and gas-related activities.

16. The information required by paragraph 14 shall include:

(a) by reference to GHG emission reduction targets (as required by Disclosure Requirement E1-4), an explanation of how the undertaking’s targets are compatible with the limiting of global warming to 1.5°C in line with the Paris Agreement;

(b) by reference to GHG emission reduction targets (as required by Disclosure Requirement E1-4) and the climate change mitigation actions (as required by Disclosure Requirement E1-3), an explanation of the decarbonisation levers identified, and key actions planned, including changes in the undertaking’s product and service portfolio and the adoption of new technologies in its own operations, or the upstream and/or downstream value chain;

(c) by reference to the climate change mitigation actions (as required by Disclosure

Requirement E1-3), an explanation and quantification of the undertaking’s investments

and funding supporting the implementation of its transition plan, with a reference to

the key performance indicators of taxonomy-aligned CapEx, and where relevant the CapEx plans, that the undertaking discloses in accordance with Commission Delegated Regulation (EU) 2021/2178;

(d) a qualitative assessment of the potential locked-in GHG emissions from the undertaking’s key assets and products. This shall include an explanation of if and how these emissions may jeopardise the achievement of the undertaking’s GHG emission reduction targets and drive transition risk, and if applicable, an explanation of the undertaking’s plans to manage its GHG-intensive and energyintensive assets and products;

(e) for undertakings with economic activities that are covered by delegated regulations on

climate adaptation or mitigation under the Taxonomy Regulation, an explanation of any objective or plans (CapEX, CapEx plans, OpEX) that the undertaking has for aligning its economic activities (revenues, CapEx, OpEx) with the criteria established in Commission Delegated Regulation 2021/213936;

(f) if applicable, a disclosure of significant CapEx amounts invested during the reporting

period related to coal, oil and gas-related economic activities;

(g) a disclosure on whether or not the undertaking is excluded from the EU Paris-aligned

Benchmarks;

(h) an explanation of how the transition plan is embedded in and aligned with the undertaking’s overall business strategy and financial planning;

(i) whether the transition plan is approved by the administrative, management and

supervisory bodies; and

(j) an explanation of the undertaking’s progress in implementing the transition plan.

17. In case the undertaking does not have a transition plan in place, it shall indicate whether and, if so, when it will adopt a transition plan.

Disclosure Requirement related to ESRS 2 SBM-3 – Material impacts, risks and opportunities and their interaction with strategy and business model

18. The undertaking shall explain for each material climate-related risk it has identified, whether the entity considers the risk to be a climate-related physical risk or climate-related transition risk.

19. The undertaking shall describe the resilience of its strategy and business model in relation to climate change. This description shall include:

(a) the scope of the resilience analysis;

(b) how and when the resilience analysis has been conducted, including the use of climate scenario analysis as referenced in the Disclosure Requirement related to ESRS 2 IRO-1 and the related application requirement paragraphs; and

(c) the results of the resilience analysis including the results from the use of scenario analysis.Source: European Sustainability Reporting Standards: ESRS E1 – Climate Change

Nature loss poses both risks and opportunities for business, now and in the future. More than half of the world’s economic output – US$44tn of economic value generation – is moderately or highly dependent on nature. The Taskforce on Nature-related Financial Disclosures (TNFD) was announced in July 2020 to develop and deliver a risk management and disclosure framework for organizations to report and act on evolving nature-related risks, with the ultimate aim of supporting a shift in global financial flows away from nature-negative outcomes and toward nature-positive outcomes. In September 2023, TNFD launched the final Recommendations of the Taskforce on Nature-related Financial Disclosures , aligned with TCFD’s four-pillar structure.